- Bodily Injury Liability Coverage: Minimum $15,000 per person / $30,000 per accident

- Property Damage Liability Coverage: Minimum $10,000

- Uninsured Motorist Bodily Injury Coverage: Minimum $15,000 per person / $30,000 per accident

- Underinsured Motorist Bodily Injury Coverage: Minimum $15,000 per person / $30,000 per accident

COLLISION INSURANCE

As the name implies, collision insurance covers damage made to your car in a crash with another vehicle. It applies even if you were at fault or if the other driver is uninsured. Once the damage has been assessed, insurance payout should go toward the cost of repairing or replacing the car. The recommended amount of collision insurance coverage depends mostly on the value of your car.

Each collision policy has a deductible. The insurance holder must pay for some of the cost of the car’s repair or replacement. The most common deductible for collision coverage costs $500 for each claim.

WHAT COLLISION COVERAGE INCLUDES

Check the fine print of your collision insurance policy, but damages caused by the following events are typically included:

- Accidents where another driver is at fault

- Accidents where you are at fault

- Accidents with an uninsured car or driver

- Collisions caused by environmental factors or road conditions

- Hit-and-run collisions

- Damage caused by another car while parked

- Collisions involving a parked car

- Running into an object (tree, pole, building, etc.)

- Backing into an object

- Rollovers

COMPREHENSIVE INSURANCE

For other vehicle damage that is not caused by an accident, there is comprehensive insurance. Insurance deductibles for comprehensive coverage generally range from $100 to $2,500 for each claim.

WHAT COMPREHENSIVE COVERAGE INCLUDES

Be sure to review the details of your collision insurance policy; damages caused by the following events are often covered:

- Car theft or damage from a break-in

- Vandalism

- Car glass damage, windshield repair or replacement

- Damage from hail, rocks, etc

- Damage from storms, flooding and natural disasters

- Fire

- Damage caused by hitting a deer or other animal

CHOOSING THE RIGHT INSURANCE FOR YOU

It can be challenging to decide what the right car insurance policy is for you and your budget. Collision and comprehensive insurance are the most popular types of optional vehicle insurance.

Consider these factors when making this important decision:

Value of the vehicle – New cars, luxury models, specialty vehicles and collector cars are usually more expensive to repair or replace. Comprehensive and collision insurance help reduce your out-of-pocket costs if something happens to your car.

Risk of collision – The risk of a collision increases in relation to the number of miles you put on it. Drivers with long commutes, use their car for work, or who rely heavily on their vehicle are more at risk.

Your location – Optional insurance is highly recommended for car owners who live in areas with high crime or which often experience severe weather.

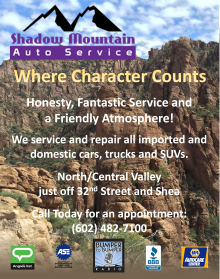

COLLISION REPAIR NEAR YOU

Click Here for more information about the Bumper to Bumper Collision Team