- The average new-vehicle retail transaction price to date in November is $32,344, a record for the month, surpassing the previous high for the month of $31,573 set in November 2016.

- Consumers are on pace to spend $36.2 billion on new vehicles in November, up nearly $800 million from last year's level.

- Average incentive spending per unit to date in November is $4,065 per unit, surpassing the previous high for the month of $4,024 set in November 2016. Spending on trucks and SUVs is $3,947, up $17 from last year. Spending on cars is $4,286, up $100.

- Incentives as a percentage of MSRP are at 10.8% so far in November, exceeding the 10% level for 16th time in the past 17 months.

- Trucks account for 66% of new-vehicle retail sales through Nov. 19—the highest level ever for the month of October—making it the 17th consecutive month above 60%.

- Days to turn, the average number of days a new vehicle sits on a dealer lot before being sold to a retail customer, is 74 through Nov. 19.

- Fleet sales are expected to total 254,500 units in November, down 0.6% from November 2016. Fleet volume is expected to account for 19% of total light-vehicle sales, flat from last year.

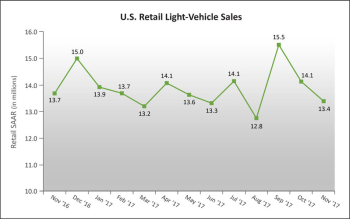

Jeff Schuster, Senior Vice President of Forecasting at LMC Automotive, said, "Thanks to incentive levels and some timed fleet sales, the sales rate in the second half of the year has remained ahead of expected natural demand, with the overall decline remaining primarily a downward adjustment to fleet mix. We believe risk heading into next year is balanced. However, without incentive intervention or a return to higher rental car fleet sales, demand is expected to contract for the second year in a row."

LMC's outlook for 2017 total light-vehicle sales rounds up to 17.2 million units, a decrease of 2.1% from 2016. The outlook for retail light-vehicle remains at 13.9 million, down 1.4% from 2016. Looking forward to 2018, total light-vehicle sales are forecasted at just under 17.0 million unit a decline of 1%. Retail light-vehicles are expected to be at 13.8 million units for 2018, a decline of 1.1%.